Direct Link

The most comprehensive online payment solution for your e-commerce

Accept multiple online payment methods at your e-commerce store with iPay88’s Direct Link payment, ensure easy checkout process, and capture more revenue.

Technology-driven solutions to your payment acquisition

Attract customers

Encourage more sales and traffic by customizing campaigns and promotions with desired discount, percentage, fixed amount, and more.

Quick management on your phone

View your transaction history, get real-time payment notifications and updates all in your smartphone.

Comprehensive report

Access consolidated reports via iPay88 Merchant Portal to facilitate financial reconciliation.

Multiple payment options

Your business will be able to accept widely accepted local payment methods such as online banking, e-wallets, bank cards, and BNPL.

Variety ways to pay

Payment options your customers love

Give your customers the freedom to pay for their purchases with payment options they want to use upon the checkout.

- Online Banking (Malaysia)

- E-wallets

- Bank Cards

- Buy Now Pay Later

- Others

Online Banking

Bank Cards

E-wallets

Buy Now Pay Later (BNPL)

Others

Improved customer experience

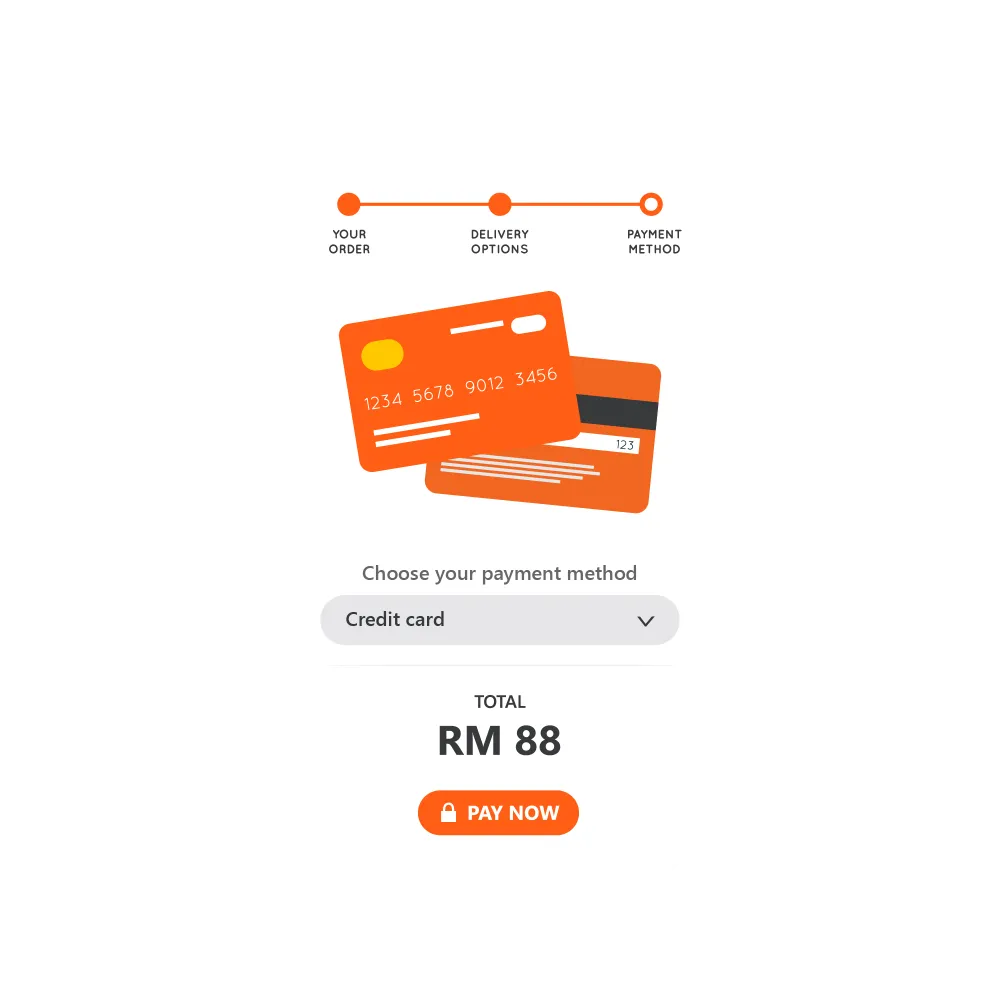

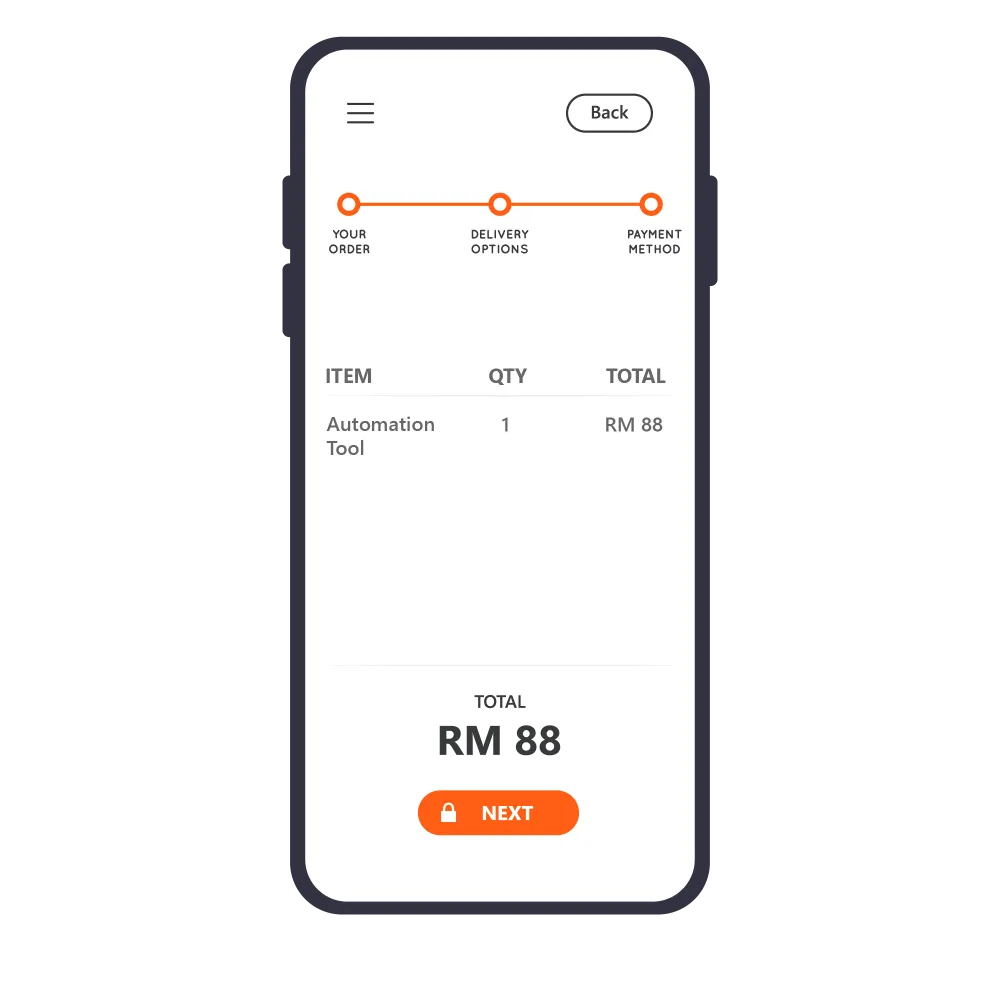

Fast and easy checkout

Deliver a seamless checkout experience by integrating with iPay88’s payment system into your website or app.

Tokenization

Simplify your customer’s checkout process as Tokenization helps to store credit card details securely without needing to repeatedly insert the information.

iPay88 hosted payment page

Dynamically integrate with the iPay88 hosted payment page and adapts to the customer’s device, supports all payment methods, and increases conversions.

Merchant hosted payment page

Be in charge to design your own payment form to match your branding. This will require you to build your own API-based integration with iPay88.

SDK Integration

Similar to web integration, your app will experience easier and faster integrating process with mobile SDK integration.

Robust External API

External API integration allows your website to connect to iPay88 through back-end to back-end communication via HTTP.

Get more with iPay88

Better customer experience

Customers can easily choose their preferred payment options to pay faster, safer, and hassle-free.

Seller protection

We use advanced technology to mitigate fraud risk so you can focus on your business growth.

Help when it’s needed

Our support team is ready to assist you or your customers throughout the shopping journey.

Marketing campaigns

As our merchant, you will have a unique opportunity to be featured in marketing campaigns by our payment partners.

Payments made easy

Start accepting wide payment methods, from e-wallets to BNPL with DirectPay app in your shop today.