Online shopping has become a trend due to convenience to shop anytime, anywhere, as everything is reachable with a single tap on a mobile phone.

The process is simple and fast, and you do not even have to leave your home to make purchases.

To make sure that your customers enjoy the entire online shopping experience, you need to make sure that your customers are able to make payments safely during the checkout process.

How to choose a payment gateway?

Payment comes as a last step in the purchasing process, thus as an e-business, you have to ensure your customers that the payment platform they will make the payment on is secure and trustworthy.

And this is where the payment gateway comes in, which is explained here as well.

Here are five factors to consider when choosing a method of payment or payment gateway for your business;

Security and reliability

You should never compromise the security of your online payment system. It should be protecting all the credit card transactions and private information of your customers. This could be done if the payment gateway supports the highest security standards imposed by central banks and complies with PCI Data Security Standard (PCI-DSS).

For example, 3D-Secure is an added layer of security feature required for Internet transactions. It gives an extra layer of assurance as a shopper has to enter a one-time-password (OTP) code sent to their registered mobile phone.

On top of that, the iPay88 payment gateway is in compliance with PCI-DSS Level 1 to ensure that all transactions are safeguarded.

Incured fees

When choosing a payment gateway, you will generally encounter different fees that vary from one company to another. What are the payment gateway charges? Below are some of the types of fees that usually incur:

- Transaction fee (MDR)

Transaction fee (MDR) or better known as “Merchant Discount Rate” is the type of fee that will be charged by the payment gateway on every successful transaction. - Setup fee

It is a one-time payment to cover the setup of the new account. - Annual fee

It is a yearly payment for the maintenance of the system, technology, and support.

Integration

The integration may be a hassle, therefore, you should ensure that a payment gateway has ready-made plugins with various shopping cart providers.

This will ease the integration process for you and will give you more space in terms of creating a good shopping environment for your customers instead.

However, do note that there is a difference between a shopping cart and a payment gateway. Plus, the choice of local or international shopping cart is vast, thus be careful in choosing one.

Fraud prevention system

You need to find a payment gateway that is equipped with a fraud protection system to filter each transaction from possible fraudulent activity.

It could be costly for you to install your own protection system thus seek to find a payment gateway that has a trustworthy and reputable anti-fraud system.

In iPay88, we have “ZepSecure”, which will help you monitor transactions and customize your security preferences.

Multiple payment methods (and currencies)

Before you start your online business (but don’t wait too long), you need to know the demographics of your customers.

If you have already started your online business, website analytics, and shipping data could show you the countries and regions that your online customers come from.

Although multiple currency is not an extremely important feature, it may be helpful to charge your customers in their local currency.

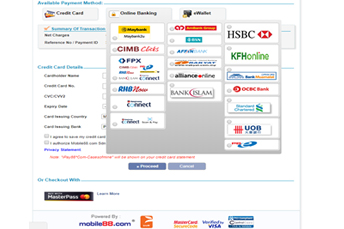

Some of the popular payment methods that are widely used such as Visa, Master, FPX, UnionPay, e-Wallet, and in-store cash. By offering more payment options, you will be able to attract more customers and generate more sales.

Conclusion

While there are many payment gateways to choose from, choosing the right payment gateway makes a significant difference for your business.

Selecting the right payment gateway can have a positive impact on your entire customer experience and profitability. We hope this blog helps you pick the right payment gateway.

You can learn more on how to apply for iPay88’s payment gateway here or get in touch with our team.