What is tokenisation?

Tokenisation is a trendy payment word in the e-commerce world. Tokenisation payment means it is an easy process that will allow you to link to your customer’s bank details with a digital token.

No additional configuration is required and it will simplify future purchases as entering bank card details will be avoided, which will speed up the checkout process.

Tokenisation enables e-Commerce business owners to provide a seamless checkout experience to their customers, especially the returning ones.

Normally, a customer credit card comes as a 16-digit number, along with the name, expiry date, and CVV code – in which all this information can be “tokenised’.

How does tokenisation work on e-commerce websites and apps?

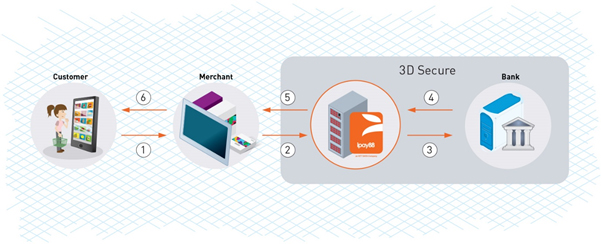

Tokenisation works by protecting cardholder details to prevent fraud. The token will be stored in the iPay88 PCI Compliant (PCI-DSS) security vault.

We explained here why PCI compliance is compulsory for every payment gateway that processes bankcard payments on e-commerce platforms.

If returning customers have tokenised their credit card details on your website, upon checkout, they will be only required to key in their CVV details instead of 16-digit credit card numbers, names, and expiration dates.

New customers need to tokenise their credit card details, to be able to use the payment tokenisation feature for their next purchases.

Why use tokenisation?

1. Increase payment success rate

For most of the e-commerce business owners, the payment success rate is critically important, as it is one of the metrics to define whether your business is generating profits or losses.

By tokenising, you will ensure that there are less steps during the checkout, which means that the customers will be able to complete their purchase faster.

It also means that there will be less place for error to happen, e.g. customer entering wrong card number or misspelling the name.

2. Reduce fraud risk

Once the customer tokenised their credit card detail, upon checkout, they will only require to key in their CVV code.

This reduces the risk of leaking customers’ private information especially when your customers are happily doing their online shopping in public places. Tokenisation usage examples:

- Businesses keep their customer card details for subscriptions and billing,

- E-commerce enables their returning customers with a one-click checkout (direct link),

- Mobile e-wallets (Boost, Vcash, iPay88 e-wallet).

3. Security of payment data

Tokenisation plays a pivotal role in securing payment data by substituting sensitive information like credit card numbers with unique tokens.

These tokens are devoid of any meaningful information on their own and are meaningless to potential attackers.

Even if unauthorized access is gained, the tokenized data remains incomprehensible without the corresponding decryption key.

This approach adds a robust layer of security to payment transactions, protecting users from the risks associated with data breaches.

4. Minimized data breach impact

The use of tokenisation minimizes the impact of data breaches on businesses. Even if attackers manage to access tokenized data, the absence of the decryption key renders the stolen information useless.

The actual financial data remains securely stored, safeguarding customers from the potential fallout of a breach. This approach not only protects businesses but also mitigates the risks and consequences for customers who entrust their sensitive information to these platforms.

5. Streamlined payment processes

Tokenisation streamlines payment processes, especially for recurring transactions and subscription models.

After the initial transaction, subsequent payments can be seamlessly processed using the token, eliminating the need for users to repeatedly enter sensitive information.

This not only enhances the user experience but also reduces friction in payment processes, making transactions more convenient and efficient for both businesses and customers.

6. Cross-platform transactions

Tokens are often designed to be platform-agnostic, enabling their use across different channels and platforms. In the context of online transactions and mobile payments, this flexibility is invaluable.

Businesses can provide a consistent and secure payment experience, regardless of the platform or device used by the customer, contributing to a seamless and user-friendly payment ecosystem.

7. Adherence to data privacy regulations

Tokenisation aids businesses in complying with stringent data privacy regulations by ensuring that sensitive information is securely stored and transmitted.

With the growing emphasis on data protection and privacy laws, businesses must adopt measures like tokenisation to align with regulatory requirements.

This not only helps in avoiding legal consequences but also demonstrates a commitment to respecting user privacy, and enhancing the reputation of the business in the eyes of customers and regulatory bodies alike.

Start your tokenisation journey with us today!

Failure to make payments does not only hurt the user experience of your customer, but the chances of customer returns, are minimal. Failure to make payments can also be frustrating to you as a merchant.

To ensure that your customers experience a seamless payment experience during checkout, tokenisation feature should be enabled.

If you have not enable tokenisation feature in your e-Commerce website or mobile apps, do contact us now to enable it!